how to claim gst refund in malaysia

Allows businesses established and registered for VAT purposes within the EU to submit a refund claim via the internet site of. 7500 still continue to pay 18 GST and enjoy ITC.

How To Collect Gst Tax Refund Eztax

No Claim BonusDiscount Available in the form of a refund in premiums either in full or partial.

. GST Goods and Services Tax Number. As per Notification No. Malaysia has a well-developed infrastructure.

Get the best cashback credit cards in Malaysia for instant savings. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018.

However restaurants as part of hotels with room tariffs exceeding Rs. It can also be a discount on your premiums if you decide to renew your. Original copy of the police report.

Lets learn how to claim it. Claiming back GST and input tax credits GST-registered businesses can claim back the GST they pay on business expenses. Working out your GST refund or payment.

All GST returns such as GST-1 23 6 and 7 needs to be filed. The GST is paid via GST Return by consumers but it is remitted to the government by the businesses selling the goods and services. If youre a GST-registered business you must add GST to your prices.

In essence the final GST quantum is borne by the consumer versus the SST in which the. McDonalds charges 5 GST and cannot claim any ITC. CESTAT Indonesia issues export permit for over 3 lakh tonnes of palm oil.

Sales and Service Tax SST in Malaysia. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come. He sells goods to Mr.

Copy of your MyKad. Malaysia beat out countries like Australia and the United Kingdom to claim this spot. General Information on GST Return Late Fees.

Exports of goods and provision of international services are mainly zero-rated supplies. A is a seller. Malaysia 6 Note.

The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report. The details uploaded by Mr. If youre putting in a claim of RM5000 for the cost of your car repairs due to an accident youll need to pay RM200 and the insurer will pay the remaining RM4800.

462017-Central Tax Rate dated 14th November 2017 standalone restaurants will charge only 5 GST but cannot enjoy any ITC on the inputs. This is how it works. Understanding The Facts And Figures More articles Housing Loan.

GST is not chargeable on exempt supplies of which there are two categories sale and lease of residential land. Despite that the total amount of tax paid under GST is actually lower due to its input tax claim mechanism. Copy of your most recent drivers license.

Here are the documents required for car insurance claim in Malaysia. You also need to issue GST invoices. Working out GST is simple maths.

Travel Credit Cards. ClearTax GST with its powerful billing vendor data mismatch reconciliation mechanism validation engines and return filing process serves as a single platform for all GST compliance. A uploads all his tax invoices details as issued in GSTR-1.

How Input Tax Works Under GST. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. You can create 100 GST complaint bills or bulk import sales and purchase data from your accounting software such as Tally in excel format.

IATA is registered for Service Tax Digital Services with the Royal Malaysian Customs Department under the Registration No. For all other back taxes or previous tax years its too. Malaysia has a strong educated workforce and English is widely used as a business language.

B is now eligible to claim the purchase credit using his purchase invoices. A GST registered entity who makes zero-rated supplies is able to claim the input tax paid on purchases. According to the GST Legislation a late fee is an amount imposed for late filing of GST Returns.

ST - Date of filing of refund claim should be reckoned as the claim of first filing of refund claim and not as per the date of filing revised refund claim.

How To Manage Value Added Tax Refunds In Imf How To Notes Volume 2021 Issue 004 2021

Allow Nris Foreigners Buying Gold To Claim Gst Refund On Their Return

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Guide To Gst Refund In Australia Bragmybag

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

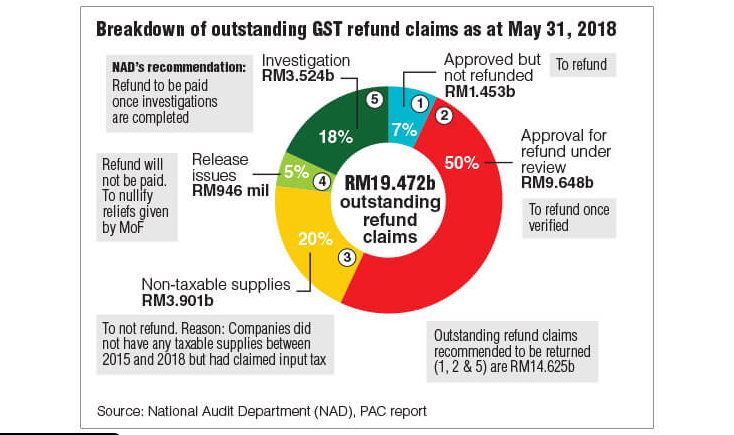

Headlines Customs Delayed Gst Refund Process As Bn Govt Lacked Money Johor Business Network

Refund Under Gst All You Need To Know Quickbooks

Faqs On Gst Refunds Demand And Recovery

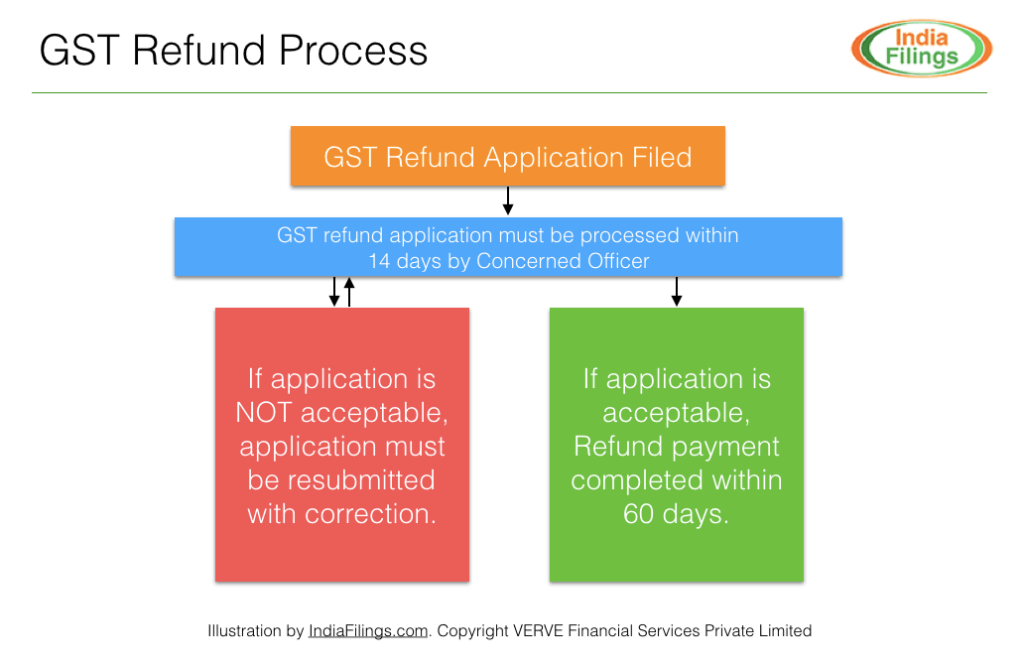

How To Get Gst Refund Indiafilings

Gst Refund I How To Check Gst Refund Status Online I With And Without Login Youtube

Guide To Tax Refund In Malaysia Bragmybag

Allow Nris To Buy Gold From Foreigners To Claim Gst Refund

How To Claim Gst In Malaysia Tips Tips Wonderful Malaysia

Complete Synopsis On Gst Refund Of Unutilised Input Tax Credit

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Claiming Your Gst Refund As You Leave Australia Economy Traveller

Guide To Gst Refund In Singapore Bragmybag

Private Transport Service With Images Singapore Changi Airport Travel Tips Singapore

No comments for "how to claim gst refund in malaysia"

Post a Comment